The Help To Buy Equity Loan

Available for newly built homes only.

What you need:

-

A minimum 5% deposit + 75% mortgage.

-

If you are approved for the scheme, the Government can lend up to 20% of the value of the new property.

How does it work?

Who is eligible?

-

First time buyers

-

Those wishing to move up the ladder and are either selling their existing property or have already sold.

It is not available for buy to let, nor properties over the value of £600,000.

Most high street lenders offer mortgages using the scheme but they must be capital repayment mortgages and the maximum mortgage given will be 4.5 times income.

What does it cost?

-

The Help To Buy Equity Loan is interest free for the first 5 years.

-

From year 6 a fee of 1.75% (of the loan amount) will be charged monthly, rising annually by RPI inflation plus 1%.

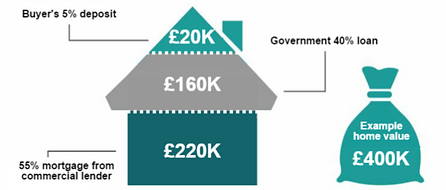

Help To Buy, London

-

You will need a minimum 5% deposit on a newly built home.

-

The Government can lend up to 40% of the value of the new property.

-

You will need to fund the remainder of the purchase price with a mortgage.

-

Check your borough here: https://www.helptobuy.gov.uk/documents/2015/12/london-definition.pdf

How to apply

Discuss with a Mortgage Adviser

We highly recommend that you discuss your eligibility and financial options with an independent mortgage adviser. They will be able to confirm various Help To Buy mortgages available to you.

Reserving your new home

When you have officially reserved a new home, you will need to complete a Help To Buy Property Information Form available from your local Help To Buy Agent http://www.helptobuy.org.uk/equity-loan/find-helptobuy-agent

Property Information

Send the Property Information Form with the new home Reservation Form to the Help To Buy Agent. We recommend that your mortgage adviser does this for you.

Your application

Your application will be assessed and eligibility confirmed. From this point, as far as the buyer is concerned, your purchase proceeds just like any other house purchase.

If you have any queries, please contact us and we’ll be happy to talk you through it!

How to repay the loan:

The equity loan can be repaid at any time within 25 years (or the term of the mortgage), or on sale of the property. When the loan is repaid, an independent valuation will be carried out to determine the proportion of any growth in the property value that must also be paid. Likewise, if the property value falls, so does the proportion of loan that has to be repaid on a pro rata basis.